Introduction: As individuals age, healthcare becomes an increasingly significant aspect of their lives. From routine check-ups to managing chronic conditions, seniors often face a myriad of healthcare expenses that can impact their financial well-being. In this blog, we delve into the complexities of senior healthcare costs, shedding light on the key factors driving these expenses and offering insights into how seniors can navigate this financial landscape.

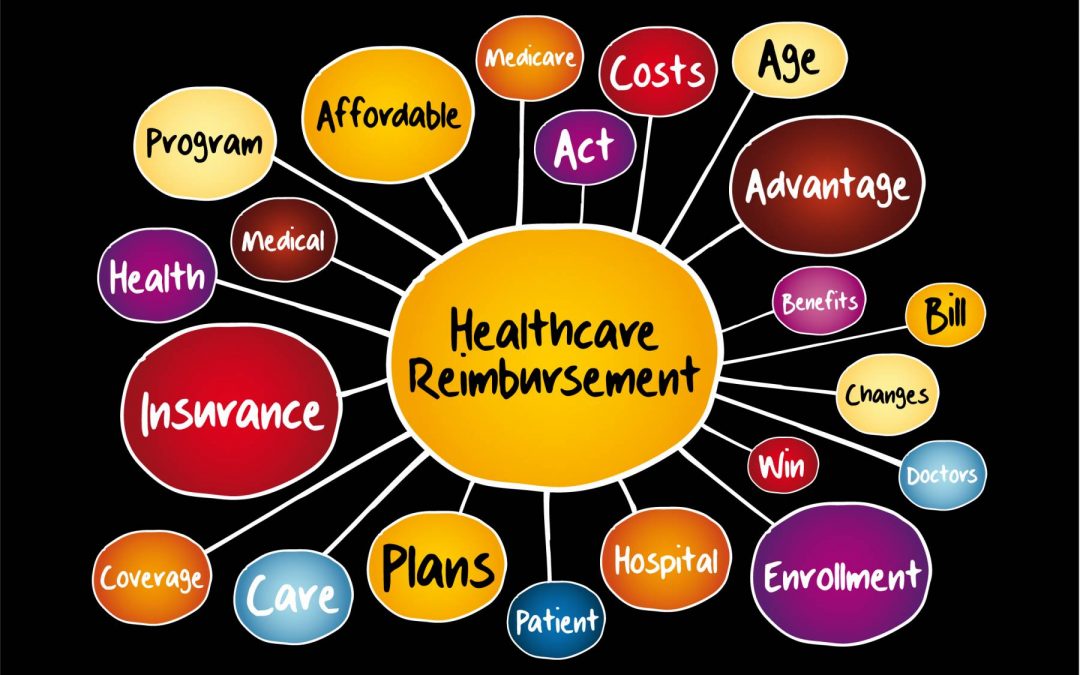

Factors Driving Senior Healthcare Costs: Several factors contribute to the rising healthcare costs for seniors:

-

Chronic Conditions: According to the Centers for Disease Control and Prevention (CDC), approximately 85% of older adults have at least one chronic health condition, such as diabetes, heart disease, or arthritis. Managing these conditions typically requires ongoing medical care, medications, and sometimes specialized treatments, all of which can incur significant expenses.

-

Medical Technology and Innovation: While advancements in medical technology have led to improved diagnoses and treatments, they often come with a hefty price tag. Cutting-edge treatments and medications can be costly, particularly for seniors who may require them to manage complex health issues.

-

Long-Term Care Needs: As individuals age, the likelihood of needing long-term care, such as nursing home care or assisted living, increases. These services can be prohibitively expensive, with the average annual cost of a private room in a nursing home exceeding $100,000, according to Genworth’s Cost of Care Survey.

-

Medicare Coverage Gaps: While Medicare provides crucial health coverage for seniors, it doesn’t cover all healthcare expenses. Gaps in coverage, such as copayments, deductibles, and services not covered by Medicare, can result in out-of-pocket costs for seniors.

Strategies for Managing Senior Healthcare Costs: Despite the challenges posed by rising healthcare costs, there are steps seniors can take to mitigate financial strain:

-

Medicare Advantage Plans: Medicare Advantage plans, also known as Medicare Part C, offer an alternative way to receive Medicare benefits through private insurance companies. These plans often provide additional coverage for services not included in original Medicare, such as dental, vision, and prescription drugs, potentially reducing out-of-pocket expenses for seniors.

-

Supplemental Insurance (Medigap): Medigap policies are designed to fill the gaps in coverage left by original Medicare, such as copayments, coinsurance, and deductibles. While premiums for Medigap policies vary, they can provide seniors with greater financial predictability by limiting out-of-pocket costs.

-

Prescription Drug Assistance Programs: Many pharmaceutical companies offer assistance programs to help seniors afford their medications, particularly for those with limited incomes. Additionally, seniors may benefit from comparing drug prices across different pharmacies and utilizing mail-order pharmacies, which can offer cost savings on prescription medications.

-

Health Savings Accounts (HSAs): Seniors enrolled in high-deductible health plans (HDHPs) may be eligible to contribute to health savings accounts. HSAs allow individuals to set aside pre-tax dollars to pay for qualified medical expenses, providing a tax-advantaged way to save for healthcare costs in retirement.

Conclusion:

As seniors navigate the complex landscape of healthcare costs, understanding the factors driving these expenses and exploring strategies for managing them is crucial. By taking proactive steps such as exploring Medicare Advantage plans, investing in supplemental insurance, and leveraging prescription drug assistance programs, seniors can better protect their financial well-being while ensuring access to the care they need. As healthcare continues to evolve, staying informed and proactive will remain essential for seniors seeking to navigate the complexities of senior healthcare costs.

Next Steps

You can always get compassionate, tailored support from us in one of these three easy ways — all completely free.

Visit our support page to request your complimentary Caregiver Workbook.

Call our Caregiver Hotline for free custom support at 855-461-2552. All questions welcome.

Send us a message describing how we can support you. Choose whether you’d like us to reach out: text, email, or snail mail.

There is no charge for these services. They’re simply an extension of our mission to help every family who calls.

Sources:

- Centers for Disease Control and Prevention (CDC): https://www.cdc.gov/chronicdisease/overview/index.htm

- Medicare.gov – Medicare Advantage Plans: https://www.medicare.gov/sign-up-change-plans/types-of-medicare-health-plans/medicare-advantage-plans

- Medicare.gov – What’s Medicare Supplement Insurance (Medigap)?: https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap

- Health Savings Accounts (HSAs) and Medicare: https://www.medicare.gov/savings/hsas-and-medicare

- https://www.medicare.gov/health-drug-plans/health-plans/your-coverage-options/MSA